Given some recent developments in terms of team

sponsorships of other power meter brands than SRM / Quarq as a way to spend

marketing budgets I was interested to see how power meter companies actually

perform / what they are doing from a social media perspective. Also, I wanted

to see some development in information on Search Volume from Google which could

(should) give a view on popularity.

I am not a social media expert but the advantages

companies can benefit from are numerous: think of broadening the company /

brand exposure / visibility at lower cost than traditional marketing, targeting

new customers. Also because there can be a communication more directly back and

forth this can also improve customer service and enables companies to gain new

information about their customers. Also because direct feedback is possible

companies can also quite quickly response to negative publications. The last

part is also a threat of course because everyone is ‘free’ to post whatever

they want and sometimes damage control just is not enough / too late or

completely inappropriate.

Questions w.r.t. the power meter brands I had were

like, which brands are active on social media, what is the sentiment around

those brands, how many are followed, liked, what is the development, how much

is being talked about these brands and (from a different order) how about search

volumes for these brands and are the companies doing some sort of webcare and

if yes, where and in what degree?

This was –as appeared later- a bit of an ambitious

starting point. To get some of these insights I dug into the internet to find

some free social media analytics tools. To be honest, I was kind of

disappointed in the quality, but maybe my expectations were too high. Also to

get a trial version of some package you have to first survive marketing people

before you can get your hands on it. So, I had to do it with things I could dig

up and in this respect is a much narrower view. And Google only gives some sort

of popularity Index, so I had to do it with that in terms of Search analysis. Anyway,

here goes.

My starting list of brands was: SRM, Powertap, Stages,

Power2max, Ibike, Rotor, Garmin Vector, Quarq (SRAM), Look Polar Keo Power, Pioneer

and Infocrank (very new). I dare to say

you have 99.9% of the power meter market.

The social media I looked at were Facebook, Google+,

Twitter, Youtube, a tiny bit on social pictures/blogs and Search (Google). I

did not look at social media from a specific weblog (Blogger.com, Wordpress,

Blogspot, etc.), perspective or any other social platform perspective. For that

you just simply have to have better data extraction- and analysis tools.

Facebook

On Facebook you can find these brands except for Look (Polar)

Keo Power, Rotor Power and Garmin Vector specifically. Polar, Look (Look Cycle)

and Garmin have several Facebook accounts for basically all of their products,

but they do not to have a separate account for their power meter product.

Garmin Vector does have a Facebook usergroup but that’s not directed by Garmin

itself I think. Rotor also has a general account as said (Rotor Bike

Components).

From the other brands Power2max had several Facebook

accounts (North America, South Africa, Greater China and Asia). Remarkably in

the continent of origin (Europe) they do not have a Facebook page.

I would have liked to see an overview of number of

posts these companies did overtime, how many likes they got from each post, how

many times these posts were shared, to how many these posts were exposed, but

as said I couldn’t find a proper tool which did that.

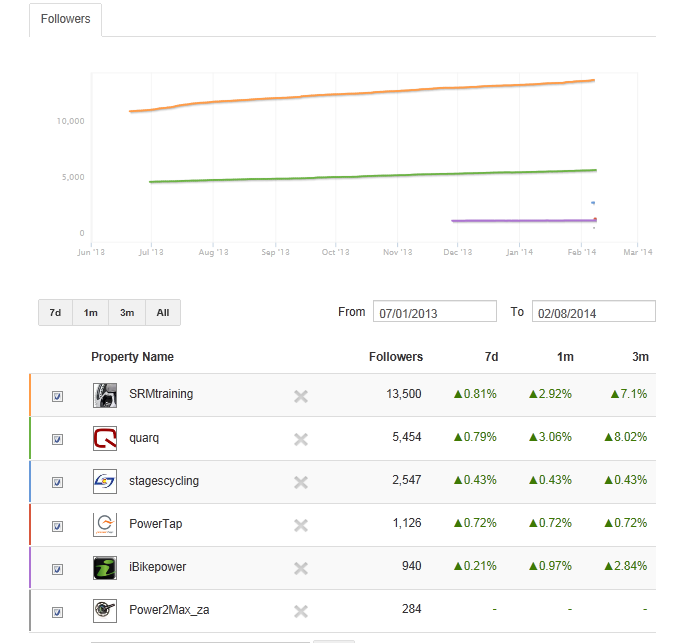

The development of the number of likes I got from a

tool called Wildfire. It has a free monitor of Twitter followers and Facebook likes.

Below you see the overview since July 2013.

Rotor Bike Components has 18.5K likes, Polar has 61K

likes, Look Cycle 84K. As said Garmin has several accounts with the biggest

214K likes.

To put some things into perspective w.r.t bicycle

components: Campagnolo has 72K likes, Shimano 127K and SRAM 125K.

Google+

Power2max Asia is on Google+ with 5 followers,

StagesCycling with 1 follower, SRM Training System with 3 followers, I Bike

with 7 followers, Powertap 5 followers (also Cycleops), Verve Cycling 3

followers. Garmin and Polar/Look are also present, but again not specifically

for Vector / Look Keo Power pedals. You can also find Pioneer (Cyclepioneer),

but in general you can say this does not seem like the hotspot for now.

Twitter

Again I used the Wildfire site to get some info. Below

you see Twitter posts (from the companies themselves) from July 2013 onwards.

Again SRM has most followers and is 2 times bigger

than the next ‘competitor’, in this case Quarq. Power2max is missing in this

overview when compared to its place on the Facebook ‘ranking’.

Look (@Velolook) has 2.4K tweets and 5400 followers. Garmin

has 52.9K followers and 9.7K tweets and Rotor (@Rotor_bike) 5.9K followers and

4K tweets. As said not specifically for the power meter products.

Below you can see the activity in terms of number of

tweets for other brands (displayed in how thick the bar is) and type of tweets

(Source: Twtrland.com)

SRM, Quarq,Stages and Power2max predominantly retweet.

These tweets of course focus on a lot of positive things others have written:

spread the good news! Ibike has a distinct pattern w.r.t. using a lot of links

(bitly and ibikesports.com) in their tweets. Also they have a lot of plain

tweets. The nature of Twitter is also shown here: not much of a picture medium

of course.

Youtube

After Google Youtube is the biggest search engine in

the world. Power2max has a Youtube account with 47 ‘subscribers’,13K views. Stages

Cycling has 102 subscribers with already 11K views. SRM Training System does

not seem to be present. Quarq Technology

has 137 subscribers and 55K views. Powertap (Cycleopspowercycling) is in

the lead in this channel with 1931 subscribers and 1.1mln views. There is one

remark to those numbers. It also encompasses all the indoor activities and not

exclusively the power meter Powertap. Pioneer is also on Youtube with

CyclePioneer and has 57 subscribers and 20K views.

Garmin is on Youtube with Garminblog (a total Garmin

account) and they have some specific videos for Vector. Those videos have been

viewed 77K times. Look has Lookcycletv

with 1K subscribers and 870K views, but Look Keo Power related videos have been

viewed about 14K times. I found Velocompibike to have Ibike videos with 160

subscribers and 243K views.

Again if I had the tooling to count comments, likes,

dislikes and the video watch time I would do it.

Pictures & Blog/forums

For some reason I did not quickly find my way on

Instagram. I should get an account first to browse a bot. On Pinterest I found

SRM (8 likes, 13 pins), Stages (4 likes, 37 pins), Ibike (although also for

their other products, 1 like, 8 pins) on Pinterest with an account. Garmin 18

likes, 495 pins (1.1K following). I couldn’t find Look/Polar however.

Of the brands considered I did find interaction with

users on companies own blogs (e.g., Garmin), but also companies interacting on

forums. A good example is the wattage group where you can find answers,

remarks, etc. from the Quarq company founder and people from Power2max. I have

also seen a ‘Official power2max support thread’ on Slowtwitch. Stages also put remarks

on the DC Rainmaker site. I actually also found a Strava Group for Power2max

South Africa with…..3 members…..

(Google) Search

In order to get a view on popularity of search for these

brands I used Google Trends. To start I used the term ‘cycling power meter’,

‘bike power meter’ for the product category, but basically these numbers are

rather similar. Below you see the graph for this category search term since

2012:

As you can see the category in all is growing in terms

of search. This is not a strange thing given more brands, lower prices, more

media attention, etc.

To level every power meter search task I used the

brand name + power + meter as search terms (except for Powertap, Garmin Vector

and Power2max). That’s my starting point and I will after that give the

drawback and the difficulty using different terms. The results since 2012 are

depicted below:

I have to admit it is a bit of a spaghetti graph. As

you can see Powertap is quite consistently biggest of all. What’s also apparent

is that the market leader SRM is quite low in popularity compared to the others.

Power2max is coming up since 2012 while you see popularity for Garmin Vector

and especially Stages bursting half 2013 until now.

The result interpretation is a bit more difficult in a

sense that if you use another search term you will get a different result and

sometimes not with the intent of finding the respective brand. If you search

for example for Powertap power meter you won’t even get weekly results in

Google Trends because the frequency for that search is too low. As an example I

have also shown below the result differences between SRM power, SRM power meter

and Powertap/Powertap power. I have not shown solely SRM because you get really

big numbers and there seems to be a strong seasonal pattern in it. If you

search for SRM on the first result page you get a printer company and Marketing

course, so SRM in itself has more references. For Powertap you do get only Powertap power meter related results so I

tend to say that this search term is quite the good general one for Powertap.

So yes, SRM might be biggest for the brands followed by Powertap, but I cannot

give more accurate results for those explicitly searching for the SRM power

meter.

So in all SRM and Powertap are probably most popular. There

is a strong growth in search popularity for the Stages power meter. Apart from

Garmin Vector and to a lesser extent Power2max search popularity seems rather

stable (of not trending slightly downward for some brands) last two years.

Summary

In terms of volume it is quite clear who is the

biggest: the one with the biggest brand heritage SRM. Stages Cycling is however

–considering the time there have been there- a remarkable player w.r.t. social

media; they do seem to take it very seriously. It’s interesting because end of

the day I was browsing on their internet site and they state: :”We know that

outside opinions of, and experiences with, a stages power meter can carry

greater weight than our own testimonials’’.

I do wonder however why a company like Garmin does not

have a separate social media platforms account for such a distinct product

category. It could be a great opportunity to interact with people, get some

more platform for their rider’s success (let it come out more than on the

‘total’ Garmin accounts), etc.

In all I am not too disappointed in social media presence

of Power meter companies and yes some do take it more seriously than others. In

my humble opinion you cannot go without presence because (future) owners are

critical and they will look / browse on the internet before (and after) they

make their purchase. I have never seen a number on it, but I might estimate

that nowadays at least 80% of people buying one has oriented themselves first

on the internet and that in the decision they eventually made the pros and cons

on all those media did weigh up a lot. A lot more than some cycling magazine

ad.

If someone does have a good sight with the right

tooling feel free to give some insights/remarks. Maybe we can both shed a light on a

lot of unanswered questions.

No comments:

Post a Comment